Arizona Capital Gains Tax 2024

Arizona Capital Gains Tax 2024. You can use our free arizona income tax. Long term capital gains tax brackets (for 2024) it should also be noted that taxpayers whose adjusted gross income is in excess of $200,000 (single filers or heads of.

Learn about tax planning strategies to reduce your capital gains taxes. The rate goes up to 15 percent on capital gains if you make between.

You Can Quickly Estimate Your Arizona State Tax And Federal Tax By Selecting The Tax Year, Your Filing Status, Gross Income And Gross Expenses, This Is A Great Way To Compare.

The rate goes up to 15 percent on capital gains if you make between.

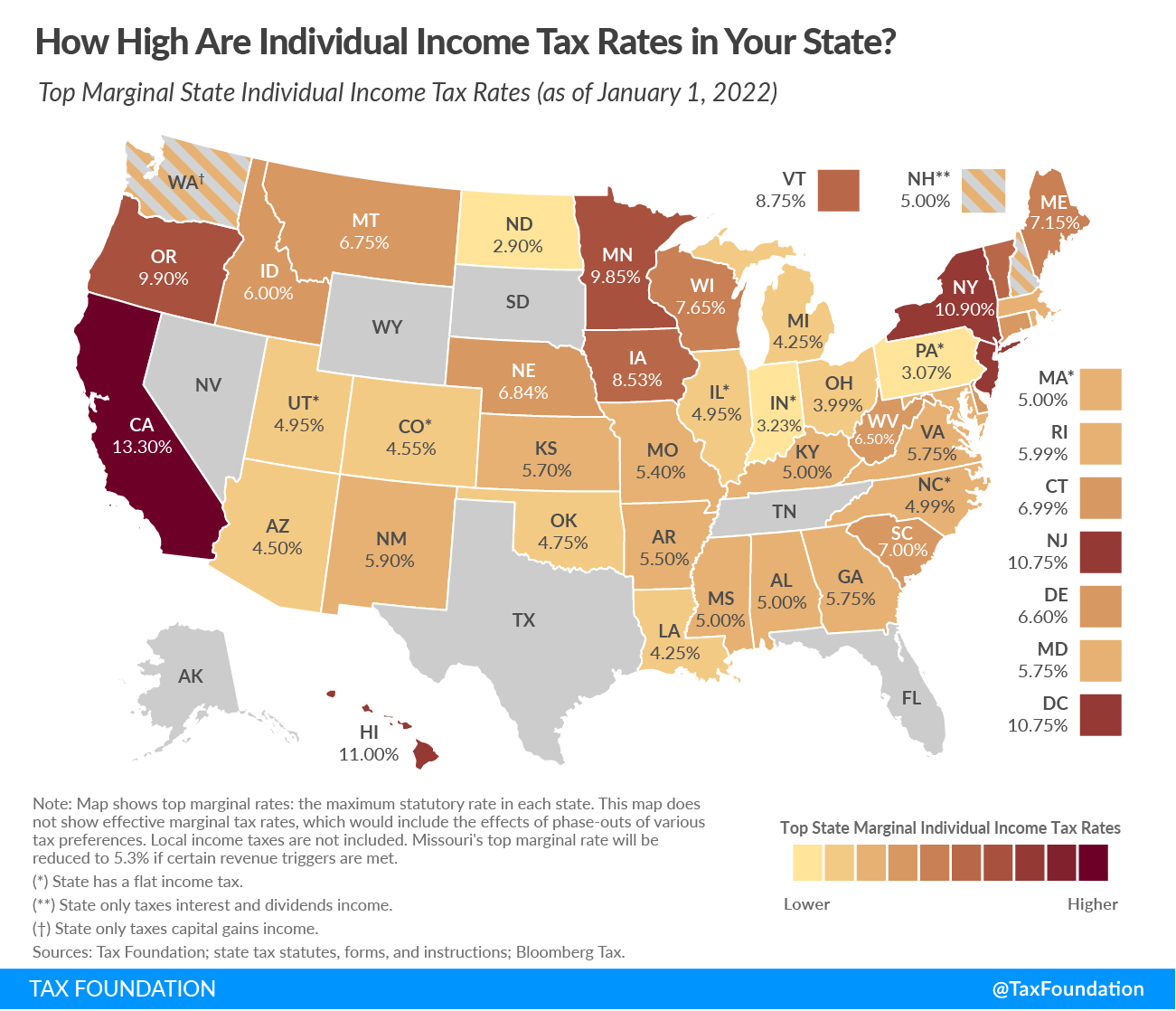

State Individual Income Taxes As Of January 1, 2024.

Understanding the role of federal capital gains tax is crucial in grasping the total tax liability from capital gains.

The Income Tax Rates And Personal Allowances In Arizona Are Updated Annually With New Tax Tables Published For Resident And Non.

Images References :

Source: neswblogs.com

Source: neswblogs.com

Arizona Capital Gains Tax Rate 2022 Latest News Update, Capital gains are subject to the same taxes as regular income, but some deductions are allowed. Values shown do not include depreciation recapture taxes.

Source: burnsandwebber.designbyparent.co.uk

Source: burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, If you make $70,000 a year living in delaware you will be taxed $11,042. Feb 21, 2018 updated mar 21, 2018.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets For 2023 And 2024, Long term capital gains tax brackets (for 2024) it should also be noted that taxpayers whose adjusted gross income is in excess of $200,000 (single filers or heads of. You earn a capital gain when you sell an investment or an asset for a profit.

Source: kindnessfp.com

Source: kindnessfp.com

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, Feb 21, 2018 updated mar 21, 2018. For married couples, that goes up to $500,000.

Source: e.tpg-web.com

Source: e.tpg-web.com

Cuddy Financial Services's Tax Planning Guide 2022 Tax Planning Guide, You earn a capital gain when you sell an investment or an asset for a profit. If you make $70,000 a year living in arizona you will be taxed $9,254.

Source: www.forbes.com

Source: www.forbes.com

The Best States to Start a Business in 2024 Forbes Advisor, You earn a capital gain when you sell an investment or an asset for a profit. You can quickly estimate your arizona state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, Learn how marginal tax brackets work. If you make $70,000 a year living in arizona you will be taxed $9,254.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Current Us Long Term Capital Gains Tax Rate Tax Walls, Values shown do not include depreciation recapture taxes. State individual income taxes as of january 1, 2024.

Source: www.transformproperty.co.in

Source: www.transformproperty.co.in

The Beginner's Guide to Capital Gains Tax + Infographic Transform, If you make $70,000 a year living in delaware you will be taxed $11,042. Capital gains are subject to the same taxes as regular income, but some deductions are allowed.

Source: taxfoundation.org

Source: taxfoundation.org

House Democrats Capital Gains Tax Rates in Each State Tax Foundation, Feb 21, 2018 updated mar 21, 2018. State individual income taxes as of january 1, 2024.

We've Got All The 2023 And 2024 Capital Gains Tax Rates In One Place.

You earn a capital gain when you sell an investment or an asset for a profit.

52 Rows State Tax Changes Taking Effect January 1, 2024.

When you realize a capital gain, the.